Will LSDFi follow in the footsteps of DeFi Summer ?

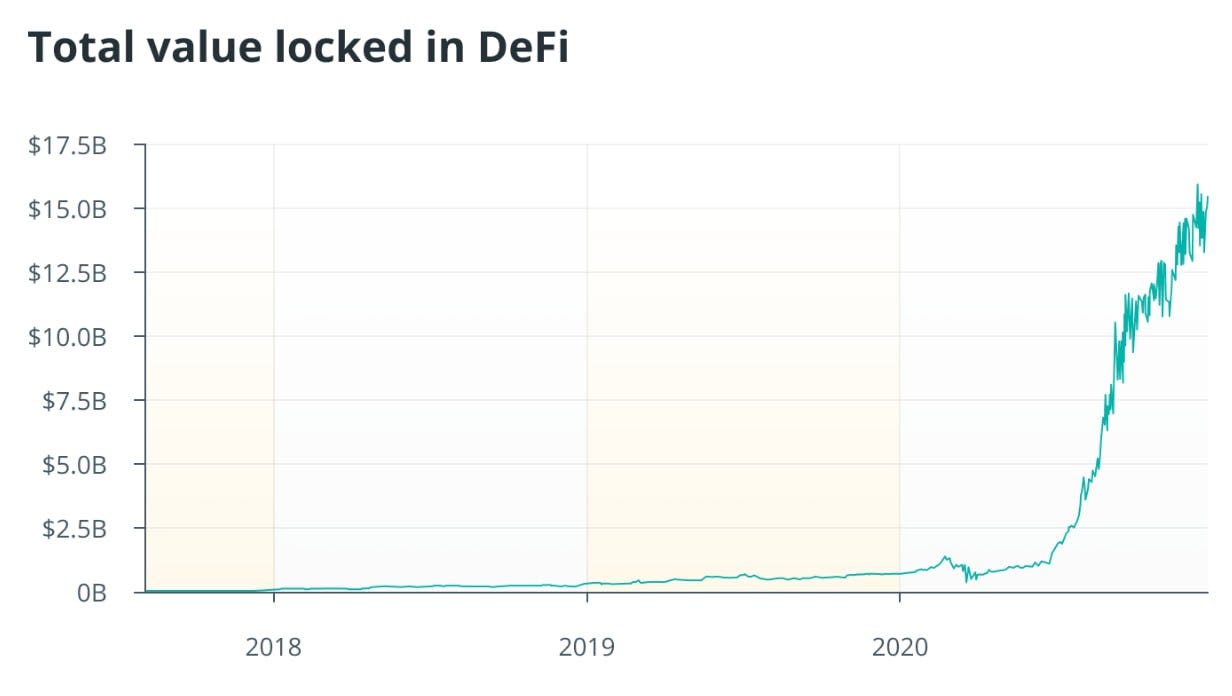

The DeFi Summer will go down in history as one of the most disruptive changes in the cryptocurrency world. It brought enormous liquidity and infrastructure growth to decentralized finance (DeFi) and provided rapid access to wealth for many investors.

Although DeFi was born in 2018, it reached unprecedented levels during the Summer of 2020. The TVL of DeFi protocols grew from millions to hundreds of billions of dollars and platforms such as Compound, AAVE, Curve, Uniswap, issued their governance tokens, reaching millions of users and providing the first farming services. These high yields led to a rapid influx of capital and then a second ‘new wave’ of investors.

Source: DeFi Pulse

A temporary step-back

With the beginning of the bear market in 2022, farming opportunities decreased as funds flowed out, and TVL fell by dozens billions of dollars. Despite this, many innovative applications have created a more inclusive, open, and composable financial system based on blockchain technology.

Over the last 6 months, the TVL of DeFi protocols has slowly picked up as market sentiment is recovering. In March, a new category known as LSDFi began to appear in the DeFi space as the size of liquid staking assets (LSD) on Ethereum grew rapidly with the completion of the Ethereum Shapella upgrade.

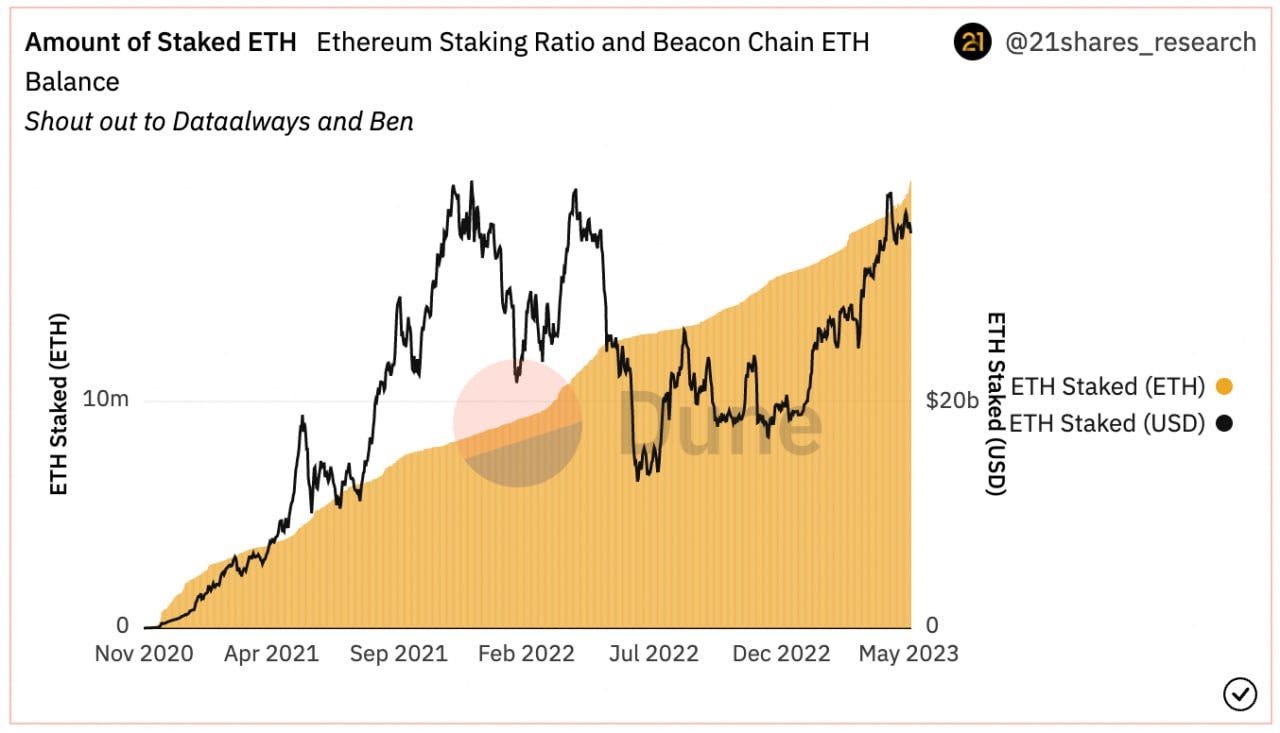

Thirty days after the completion of the upgrade, ETH staking volume has surpassed 19,000,000 ETH. With the potential to reach hundreds of billions of dollars, LSD is an essential underlying product within DeFi that can no longer be ignored. This is already driving developers to create new DeFi applications based on LSD, named in fact LSDFi.

What are the progresses within LSDFi? What is possible to built on it? And, most importantly, is LSDFi able to replicate the incredible development brought to the crypto ecosystem by the DeFi Summer?

Source: Dune Analytics

A New LSD Competition?

With the development of this new narrative, LSD based projects are in fierce competition to gain the highest staking volumes and liquidity.

LSD projects provide the opportunity for users to increase their revenue, with a mechanism of staking that unlocks their liquidity, allowing them to pursue different opportunities.

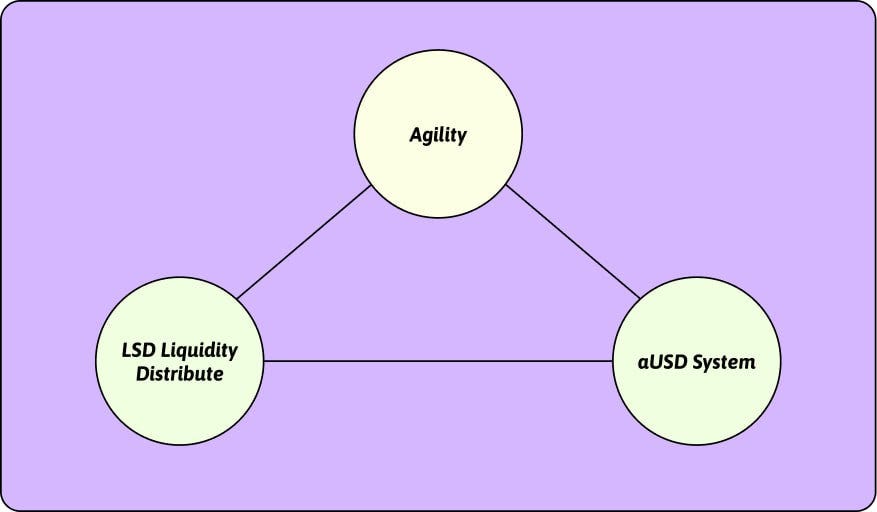

Some LSD projects have emerged to help users aggregate various types of LSD assets and guide them to get the highest returns through specific strategies. These projects (ie., Balancer, Aura, Agility) aggregate liquidity and sell it to LSD project owners with a so-called flywheel economy model, similar to the one proposed by Curve.

Collateral-based protocols

There are three type of collateral-based protocols: over-collateralized stablecoins, lending, and synthetic assets. Even if they achieve different goals, we will collectively refer to them as collateralized protocols.

Some collateral-based protocols (MakerDAO, AAVE, etc.) have already listed LSD assets as underlying assets, allowing users to enjoy staking benefits while gaining the corresponding utility. Users can also achieve leveraged stakings through revolving lending.

In addition to this, we are seeing some new players taking advantage of the LSDFi boom. Examples include *Agility’*s aUSD and Lybra Finance’s eUSD, both looking to gain stablecoin market share. These new protocols are offering high returns to attract users to mint and provide them liquidity.

Agility’s Vision

Index protocols

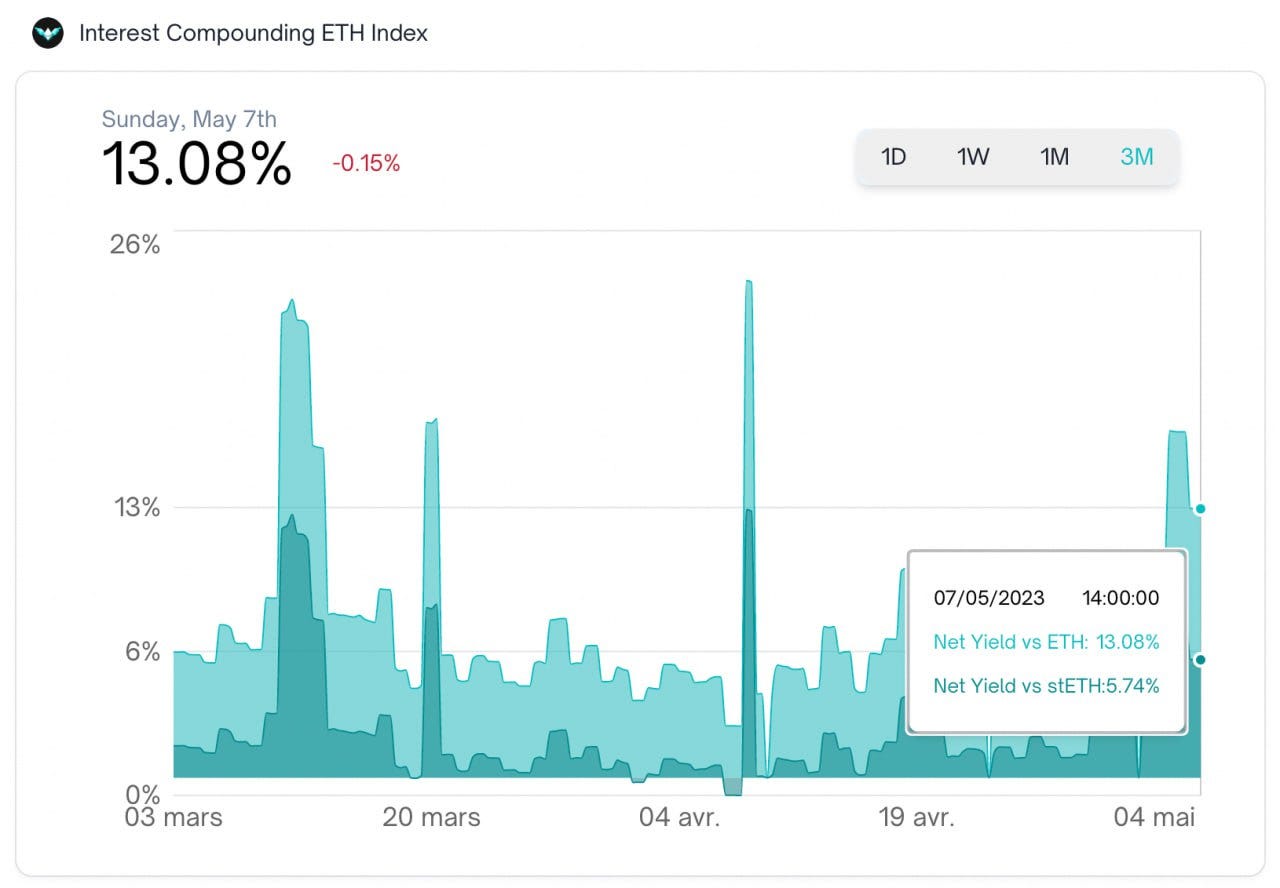

Due to the increasing amount of LSD assets in the market, Index protocols combine different assets into a basket of LSDs, according to specific ratios and strategies, issuing so-called Index LSD Assets.

Indexcoop has launched two Index LSDs, dsETH and icETH. dsETH is a normal ETH LSD, while icETH is a risk-adjusted Index LSD more volatile than dsETH, leveraged by AAVE. gtcETH is roughly the same as dsETH, except that some of the proceeds from gtcETH are donated to Gitcoin.

The emerging protocol Unsh has also launched its Index ETH product, which currently supports the minting of UnshETH with four ETH LSDs: sfrxETH, rETH, wstETH, and cbETH.

IndexCoop’s icETH Yield

Interest Rate Derivatives protocols

Interest rate derivatives have been a gap in the DeFi space for a long time, and attempts at fixed rate protocols in the DeFi space have failed repeatedly. Previously, interest-bearing assets were absent in the DeFi space, making it difficult to focus on building greater liquidity and motivating developers to explore innovation.

This problem has been solved by the rise of ETH LSD.

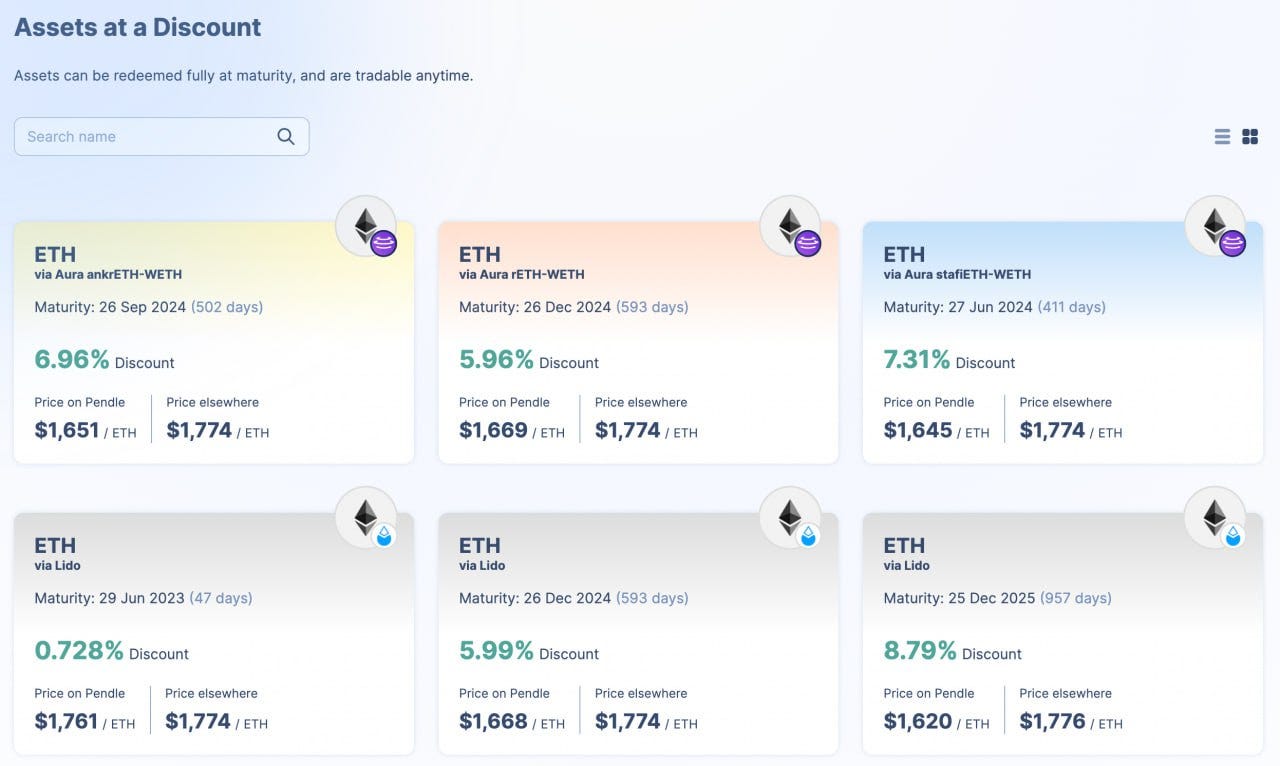

As a result, the interest rate derivatives protocol Pendle has collected interesting results since the Shapella upgrade. Pendle present itself as a new platform for buying futures: Users get a long-term fixed rate by buying futures at a discount, bringing a massive innovation into the LSD space.

There are also protocols which promises to bring a disruptive change within the ecosystem. Ion Protocol, for example, which is not live yet, it assures to be the first Index protocol for ETH LSD that split principal and revenue components into allETH (equal to ETH in value) and vaETH.

The ETH price of vaETH will increase as the revenue accumulates.

Pendle UI - ETH Discount Market

More possibilities

From the perspective of these current LSDFi products, the LSDFi space is still relatively early. There are still many opportunities for innovation, with the potential for more combinations and forms of service in the future:

- The number of nested layers can be increased. In addition to LSD assets, their LP tokens can also be used as the underlying assets to participate in the collateral, income aggregation, and Index products to generate multiple returns.

- With the split into principal and income components, more derivatives and trading methods to leverage the opportunity brought by income components will born: Interest rate swaps are just one of them.

- Based on ERC3525, more flexible and diversified financial instruments-based derivatives will be generated. (ERC3525 is a Token standard particularly suitable for financial instruments but has not yet been used on a large scale.)

LSD Mechanism

Conclusion

LSD is to the DeFi space what treasury bonds are to the real world of finance. Its existence will give DeFi a completely different purpose.

With the development of LSDFi, Bifrost will expand the application of vToken expanding their interoperability to more protocols and applications.

At the same time, Bifrost will also stimulate innovation in this space promoting the development of LSDFi economy through formats such as Hackathons, Grants and Workshops.